Page 34 - TurkInsurance Digital Magazine

P. 34

32 country profile

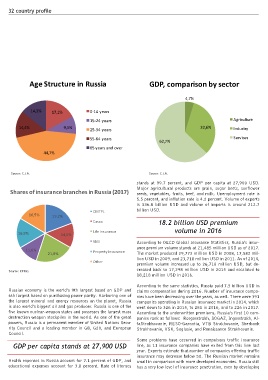

Age Structure in Russia GDP, comparison by sector

4,7%

14,3% 17,1% 0-14 years

15-24 years Agriculture

14,4% 9,5% 25-34 years 32,6% Industry

55-64 years 62,7% Services

65 years and over

44,7%

Source: C.I.A. Source: C.I.A.

stands at 99.7 percent, and GDP per capita at 27,900 USD.

Shares of insurance branches in Russia (2017) Major agricultural products are grain, sugar beets, sunflower

seeds, vegetables, fruits, beef, and milk. Unemployment rate is

5.5 percent, and inflation rate is 4.2 percent. Volume of exports

is 336.8 billion USD and volume of imports is around 212.7

CMTPL billion USD.

16,5% 19,2%

Casco 18.2 billion USD premium

16,9% 14,0% Life insurance volume in 2016

VMI According to OECD Global Insurance Statistics, Russia’s insur-

11,6% Property insurance ance premium volume stands at 21,485 million USD as of 2017.

21,8% The market produced 29,772 million USD in 2008, 17,582 mil-

lion USD in 2009, and 23,718 million USD in 2011. As of 2014,

Other

premium volume increased up to 26,718 million USD, but de-

creased back to 17,298 million USD in 2015 and escalated to

Source: KPMG

18,218 million USD in 2016.

According to the same statistics, Russia paid 7.5 billion USD in

Russian economy is the world’s 9th largest based on GDP and claims compensation during 2016. Number of insurance compa-

6th largest based on purchasing power parity. Harboring one of nies have been decreasing over the years, as well. There were 391

the largest mineral and energy resources on the planet, Russia companies operating in Russian insurance market in 2014, which

is also world’s biggest oil and gas producer. Russia is one of the went down to 326 in 2015, to 251 in 2016, and to 226 in 2017.

five known nuclear-weapon states and possesses the largest mass According to the underwritten premiums, Russia’s first 10 com-

destruction weapon stockpiles in the world. As one of the great panies rank as follows: Rosgosstrakh, SOGAZ, Ingosstrakh, Al-

powers, Russia is a permanent member of United Nations Secu- faStrakhovanie, RESO-Garantia, VTB Strakhovanie, Sberbank

rity Council and a leading member in G8, G20, and European Strakhovanie, VSK, Soglasie, and Renaissance Strakhovanie.

Council.

Some problems have occurred in compulsory traffic insurance

GDP per capita stands at 27,900 USD line, as 11 insurance companies have exited from this line last

year. Experts estimate that number of companies offering traffic

insurance may decrease below 50. The Russian market remains

Health expenses in Russia account for 7.1 percent of GDP, and small in comparison with more developed economies. Russia still

educational expenses account for 3.8 percent. Rate of literacy has a very low level of insurance penetration, even by developing