Page 26 - Turkinsurance Digital Magazine

P. 26

24 pension outlook

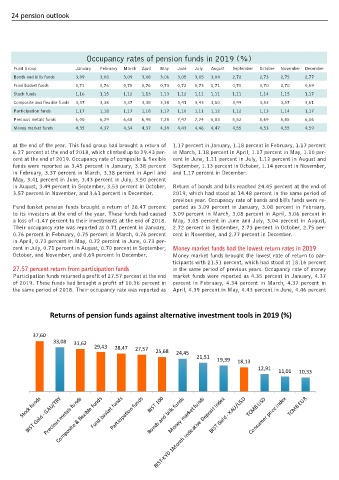

Occupancy rates of pension funds in 2019 (%)

Fund Group January February March April May June July August September October November December

Bonds and bills funds 3,09 3,08 3,09 3,08 3,06 3,05 3,05 3,04 2,72 2,73 2,75 2,77

Fund basket funds 0,71 0,76 0,75 0,76 0,73 0,72 0,73 0,71 0,70 0,70 0,70 0,69

Stock funds 1,16 1,15 1,12 1,13 1,13 1,12 1,11 1,11 1,11 1,14 1,15 1,17

Composite and flexible funds 3,37 3,38 3,37 3,38 3,38 3,41 3,43 3,50 3,49 3,53 3,57 3,61

Participation funds 1,17 1,18 1,17 1,18 1,17 1,10 1,11 1,12 1,12 1,13 1,14 1,17

Precious metals funds 6,00 6,29 6,68 6,98 7,28 7,47 7,74 6,03 5,52 5,69 5,85 6,06

Money market funds 4,35 4,37 4,34 4,37 4,39 4,43 4,46 4,47 4,55 4,53 4,55 4,59

at the end of the year. This fund group had brought a return of 1.17 percent in January, 1.18 percent in February, 1.17 percent

6.27 percent at the end of 2018, which climbed up to 29.43 per- in March, 1.18 percent in April, 1.17 percent in May, 1.10 per-

cent at the end of 2019. Occupancy rate of composite & flexible cent in June, 1.11 percent in July, 1.12 percent in August and

funds were reported as 3.45 percent in January, 3.38 percent September, 1.13 percent in October, 1.14 percent in November,

in February, 3.37 percent in March, 3.38 percent in April and and 1.17 percent in December.

May, 3.41 percent in June, 3.43 percent in July, 3.50 percent

in August, 3.49 percent in September, 3.53 percent in October, Return of bonds and bills reached 24.45 percent at the end of

3.57 percent in November, and 3.61 percent in December. 2019, which had stood at 14.48 percent in the same period of

previous year. Occupancy rate of bonds and bills funds were re-

Fund basket pension funds brought a return of 28.47 percent ported as 3.09 percent in January, 3.08 percent in February,

to its investors at the end of the year. These funds had caused 3.09 percent in March, 3.08 percent in April, 3.06 percent in

a loss of -1.47 percent to their investments at the end of 2018. May, 3.05 percent in June and July, 3.04 percent in August,

Their occupancy rate was reported as 0.71 percent in January, 2.72 percent in September, 2.73 percent in October, 2.75 per-

0.76 percent in February, 0.75 percent in March, 0.76 percent cent in November, and 2.77 percent in December.

in April, 0.73 percent in May, 0.72 percent in June, 0.73 per-

cent in July, 0.71 percent in August, 0.70 percent in September, Money market funds had the lowest return rates in 2019

October, and November, and 0.69 percent in December. Money market funds brought the lowest rate of return to par-

ticipants with 21.51 percent, which had stood at 18.16 percent

27.57 percent return from participation funds in the same period of previous years. Occupancy rate of money

Participation funds returned a profit of 27.57 percent at the end market funds were reported as 4.35 percent in January, 4.37

of 2019. These funds had brought a profit of 10.36 percent in percent in February, 4.34 percent in March, 4.37 percent in

the same period of 2018. Their occupancy rate was reported as April, 4.39 percent in May, 4.43 percent in June, 4.46 percent

Returns of pension funds against alternative investment tools in 2019 (%)

37,60

33,08 31,62

29,43 28,47 27,57 25,68

24,45

21,51 19,39 18,13

12,91 11,01 10,33

BIST Gold - GAU/TRY

Composite & flexible funds

Participation funds

Consumer price index

Bonds and bills funds

BIST-KYD 1Month Indicative Deposit Index

Stock funds Precious metals funds Fund basket funds BIST 100 Money market funds BIST Gold - XAU/USD TCMB USD TCMB EUR