Page 22 - Turkinsurance Digital Magazine

P. 22

22 pension outlook

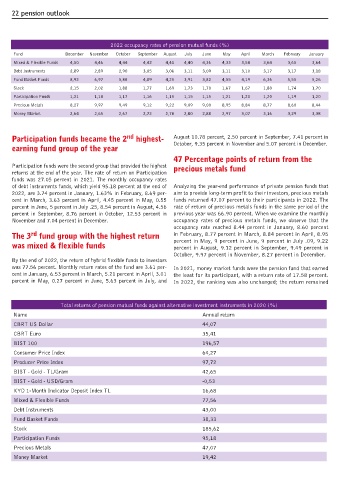

2022 occupancy rates of pension mutual funds (%)

Fund December November October September August July June May April March February January

Mixed & Flexible Funds 4,50 4,46 4,44 4,42 4,41 4,40 4,36 4,33 3,58 3,64 3,65 3,64

Debt Instruments 2,89 2,89 2,90 3,05 3,06 3,11 3,09 3,11 3,10 3,17 3,17 3,18

Fund Basket Funds 8,92 6,97 5,88 4,89 4,25 3,91 3,82 4,55 4,19 6,36 5,55 5,26

Stock 2,15 2,02 1,88 1,77 1,69 1,73 1,70 1,67 1,67 1,80 1,74 1,70

Participation Funds 1,21 1,18 1,17 1,16 1,15 1,15 1,15 1,21 1,20 1,20 1,19 1,20

Precious Metals 8,27 9,97 9,49 9,12 9,22 9,09 9,00 8,95 8,84 8,77 8,60 8,44

Money Market 2,64 2,65 2,67 2,72 2,78 2,80 2,88 2,97 3,07 3,16 3,29 3,38

nd

Participation funds became the 2 highest- August 10.78 percent, 2.50 percent in September, 7.41 percent in

earning fund group of the year October, 9.35 percent in November and 5.07 percent in December.

47 Percentage points of return from the

Participation funds were the second group that provided the highest precious metals fund

returns at the end of the year. The rate of return on Participation

funds was 27.05 percent in 2021. The monthly occupancy rates

of debt instruments funds, which yield 95.18 percent at the end of Analyzing the year-end performance of private pension funds that

2022, are 3.74 percent in January, 1.63% in February, 8.69 per- aim to provide long-term profit to their investors, precious metals

cent in March, 3.63 percent in April, 4.45 percent in May, 0.55 funds returned 47.07 percent to their participants in 2022. The

percent in June, 5 percent in July .25, 8.54 percent in August, 4.56 rate of return of precious metals funds in the same period of the

percent in September, 8.76 percent in October, 12.53 percent in previous year was 66.90 percent. When we examine the monthly

November and 7.04 percent in December. occupancy rates of precious metals funds, we observe that the

occupancy rate reached 8.44 percent in January, 8.60 percent

rd

The 3 fund group with the highest return in February, 8.77 percent in March, 8.84 percent in April, 8.95

was mixed & flexible funds percent in May, 9 percent in June, 9 percent in July .09, 9.22

percent in August, 9.12 percent in September, 9.49 percent in

October, 9.97 percent in November, 8.27 percent in December.

By the end of 2022, the return of hybrid flexible funds to investors

was 77.56 percent. Monthly return rates of the fund are 3.61 per- In 2021, money market funds were the pension fund that earned

cent in January, 6.53 percent in March, 5.21 percent in April, 3.01 the least for its participant, with a return rate of 17.58 percent.

percent in May, 0.27 percent in June, 5.63 percent in July, and In 2022, the ranking was also unchanged; the return remained

Total returns of pension mutual funds against alternative investment instruments in 2020 (%)

Name Annual return

CBRT US Dollar 44,07

CBRT Euro 35,41

BIST 100 196,57

Consumer Price Index 64,27

Producer Price Index 97,72

BIST - Gold - TL/Gram 42,65

BIST - Gold - USD/Gram -0,53

KYD 1-Month Indicator Deposit Index TL 16,68

Mixed & Flexible Funds 77,56

Debt Instruments 43,00

Fund Basket Funds 38,33

Stock 185,62

Participation Funds 95,18

Precious Metals 47,07

Money Market 19,42