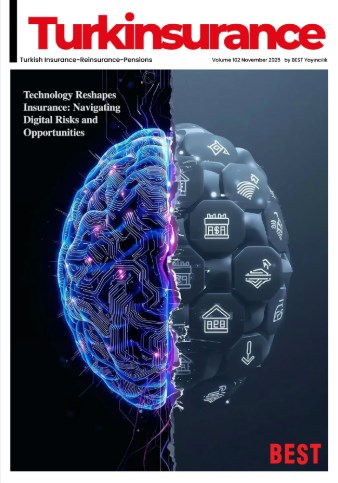

''The Digital Future of Insurance Discussed in Istanbul''

The second day of the 4th International Insurance Summit, one of the most important gatherings shaping the future of the insurance sector, was crowned by the 17th International Istanbul Insurance Conference. Organized by the Insurance Practitioners Association and IUC with the support of the Insurance Association of Türkiye (TSB), the conference addressed topics such as digitalization, climate risks, capital markets, and new insurance models. The panels, featuring prominent local and international speakers, drew attention with powerful messages set to shape the future of the industry.

On the second day of the 4th International Insurance Summit, organized by the Insurance Association of Türkiye (TSB) as part of the 14th Insurance Week, the 17th International Istanbul Insurance Conference was held. Supported by the Insurance Association of Türkiye (TSB) and organized in collaboration with the Insurance Practitioners Association and IUC, the conference brought together key local and international representatives of the insurance industry in Istanbul.

In the opening speeches, the transformative role of digitalization in the insurance value chain, the sector’s financial resilience, opportunities in global markets, and Türkiye’s vision of becoming a regional insurance hub were highlighted. Throughout the day, panels focused on critical topics such as new products, technological developments, combating the climate crisis, and integration with capital markets.

Emine Feray Sezgin: “Digitalization is transforming every stage of the insurance value chain”

In her opening speech at the conference, Deputy President of the Insurance and Private Pension Regulation and Supervision Agency (SEDDK) Emine Feray Sezgin emphasized that digitalization is creating a profound transformation at nearly every stage of the insurance value chain.

In her remarks, Sezgin comprehensively assessed the opportunities that digitalization offers to the sector as well as the responsibilities it entails.

She stated: “Digitalization is transforming every stage of the insurance value chain. From underwriting to claims processes, from customer relations to the prevention of insurance fraud, we now see the impact of digital tools at every point. This transformation is not merely an increase in efficiency; it is a revolution that fundamentally changes the logic of insurance operations, product design, and risk management.”

Emphasizing that technologies such as big data, cloud computing, the Internet of Things, blockchain, and artificial intelligence hold strategic importance for the sector, Sezgin added: “Accurate risk pricing has been the fundamental basis of insurance throughout history. However, today we can go beyond historical statistics and achieve much more precise and fair pricing through real-time data flow, advanced analytical methods, and artificial intelligence algorithms. Particularly in reinsurance pricing, the opportunities provided by artificial intelligence enhance accuracy and speed, reduce uncertainties, enable more efficient use of capital, and allow for portfolio optimization.”

Pointing out that along with the opportunities brought by artificial intelligence and digitalization come significant responsibilities, Sezgin continued: “The transparency of AI-driven decisions, data security, protection of personal data, and safeguarding of customer rights are among the issues that we must approach with great care.” “As SEDDK, while fostering innovation, we also attach great importance to maintaining market discipline and consumer trust,” she said.

At the end of her speech, Sezgin summarized SEDDK’s vision with the following words: “We do not view the innovations brought by digitalization merely as technological progress. We see this transformation as a process that strengthens the rights of policyholders, ensures a fairer distribution of risks, and enhances global resilience. Our goal is to establish a secure, transparent, and inclusive regulatory framework, increase our sector’s global competitiveness, and make our country a regional center for insurance and reinsurance.”

Ahmet Yaşar: “Türkiye’s insurance sector has tremendous potential”

In his speech at the conference, Deputy Chairperson of the Insurance Association of Türkiye (TSB) Ahmet Yaşar presented a comprehensive overview of the size achieved by Türkiye’s insurance sector and its future goals.

Yaşar stated that by the end of 2025, the sector is expected to reach 1.2 trillion TL in premium production, currently provides 2.4 trillion TL in funds to the economy, and as of 2024, has paid 339 billion TL in compensation to policyholders. He added: “This picture shows us that insurance is not merely about financial indicators; it also represents a strong mechanism of solidarity that stands beside individuals and businesses.”

Emphasizing that global premium production currently stands at 7.2 trillion dollars, while Türkiye’s share is only 0.45%, Yaşar said: “The fact that this rate appears low also points to a vast area of opportunity, because our country has an enormous, yet untapped, growth potential ahead.”

Sharing the 2030 vision, Yaşar stated that the goal is to achieve a 4.7% penetration rate and 44.3 billion dollars in premium production, while reaffirming their determination to make Istanbul a regional insurance and reinsurance hub: “Our vision is clear and straightforward: To place Türkiye’s insurance sector among the world’s top 10 markets. Our mission is to shift from ; claim-paying insurance to risk-preventing insurance. This transformation will benefit not only the sector but society as a whole.”

Highlighting the critical role of digitalization in this journey, Yaşar said: “Digitalization is no longer a choice but a necessity. Artificial intelligence is transforming dynamic pricing and claims processes; big data is strengthening the understanding of preventive insurance; blockchain is enhancing the transparency of policies and reinsurance chains. Digital payment systems, on the other hand, are making insurance a natural part of everyday life. In this way, our sector is becoming both faster and more inclusive.”

Yaşar noted that they aim to reach wider audiences with new products and stated that innovative applications such as parametric insurance, microinsurance, embedded insurance, and cybersecurity solutions will become more widespread in the upcoming period. Stating that “Insurance is not merely a transfer of risk; it is also a mechanism of trust that enhances the resilience capacity of societies,” Yaşar reminded that the earthquakes of February 6, 2023, once again revealed this truth. Finally, touching upon the alignment between public policies and the sector, Yaşar said: “Topics such as Compulsory Disaster Insurance, Building Completion Insurance, the Complementary Pension System, and participation insurance have already been included in the Medium-Term Program. These visionary steps will strengthen Türkiye’s global role in the field of insurance. As a sector, we are determined to continue this journey transparently and innovatively, through both national and international collaborations.”

Fahri Altıngöz: “We are in an era of unprecedented change”

President of the Insurance Practitioners Association Fahri Altıngöz emphasized the importance of the conference and expressed his satisfaction in bringing together leading representatives of the sector from both national and global markets in Istanbul. Altıngöz stated, “The theme of our summit, ‘Digital Future,’ is not merely a topic of discussion but a reality we encounter every day. The pace of innovation makes collaboration and the development of a shared vision a necessity.” He added that this gathering, which shapes the future of the sector, will pave the way for lasting collaborations.

website.gif)

.gif)