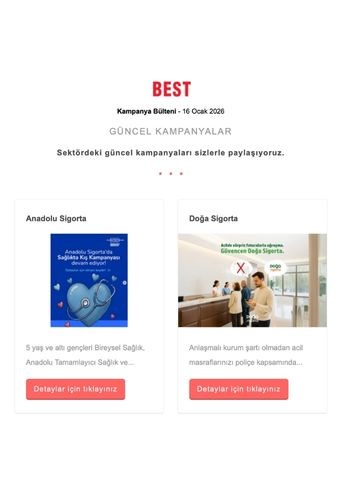

Anadolu Sigorta Exceeded Market Expectations with Its Fourth-Quarter 2025 Performance

Anadolu Sigorta, which generated premium production of TL 97.9 billion in 2025, increased its premium production by 40.7% compared to the previous year.

Compared to the previous year, while Anadolu Sigorta increased its premium production by 40.7%, its total assets reached TL 134.4 billion, and the size of the investment-directed portfolio rose by 41.1% since the beginning of the year to TL 78.3 billion.

In its 100th year, Anadolu Sigorta increased its equity to TL 41.3 billion, while the company’s average return on equity stood at 35.4% and its net profit amounted to TL 12.7 billion. Consolidated net profit increased by 16.4% compared to the previous year, reaching TL 13.4 billion.

With its strong performance, the company increased its fourth-quarter net profit to TL 4.1 billion, achieving a 36.4% increase in net profit compared to the same quarter of the previous year.

In the final quarter of 2025, Anadolu Sigorta improved its combined ratio by 3.9 points compared to the previous quarter, with the improvement in the loss ratio reaching 4.5 points.

Strengthening its robust capital structure, Anadolu Sigorta reached a capital adequacy ratio of 206.4% at year-end, continuing to provide long-term confidence to its stakeholders.

According to the announced results, Anadolu Sigorta’s highest premium production branch was “Fire and Natural Disasters” with TL 20.2 billion. This was followed by “Health and Sickness” with TL 20.0 billion, “Motor Third Party Liability” with TL 19.6 billion, and “Motor Vehicles” with TL 19.0 billion.

Anadolu Sigorta’s premium production by branch for 2025 is as follows:

|

|

12.2024 |

Change (%) |

|

|

|

|

12.25-12.24 |

|

|

ACCIDENT |

2.076.447.091 |

1.353.451.063 |

53,4 |

|

HEALTH / SICKNESS |

20.012.177.844 |

12.689.734.671 |

57,7 |

|

MOTOR VEHICLES |

18.969.719.391 |

14.993.977.028 |

26,5 |

|

AIRCRAFT |

595.699.466 |

659.051.888 |

-9,6 |

|

MARINE VESSELS |

2.381.548.873 |

1.799.900.166 |

32,3 |

|

TRANSPORTATION |

1.802.476.062 |

1.534.099.167 |

17,5 |

|

FIRE AND NATURAL DISASTERS |

20.237.677.236 |

14.910.046.793 |

35,7 |

|

GENERAL DAMAGES |

6.519.188.249 |

4.493.098.609 |

45,1 |

|

MOTOR THIRD PARTY LIABILITY |

19.563.532.946 |

13.643.838.029 |

43,4 |

|

AIRCRAFT LIABILITY |

361.203.915 |

413.383.174 |

-12,6 |

|

GENERAL LIABILITY |

2.839.402.778 |

1.686.699.455 |

68,3 |

|

CREDIT |

71.547.897 |

44.633.512 |

60,3 |

|

SURETY |

85.561.919 |

261.139.253 |

-67,2 |

|

FINANCIAL LOSSES |

825.487.847 |

630.360.830 |

31,0 |

|

LEGAL PROTECTION |

1.541.455.867 |

475.708.547 |

224,0 |

|

TOTAL NON-LIFE |

97.883.127.381 |

69.589.122.185 |

40,7 |

|

LIFE |

0 |

0 |

|

|

GRAND TOTAL |

97.883.127.381 |

69.589.122.185 |

40,7 |