Page 20 - Turkinsurance Digital Magazine

P. 20

18

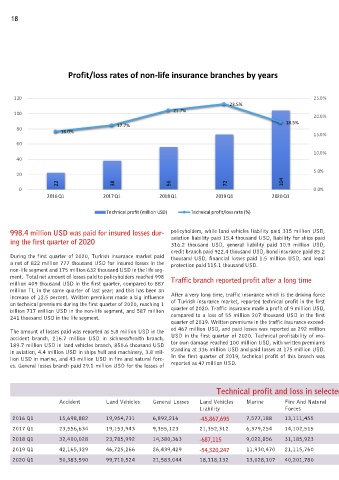

Profit/loss rates of non-life insurance branches by years

120 25.0%

23.5%

21.7%

100

20.0%

18.5%

17.7%

80

16.0%

15.0%

60

10.0%

40

5.0%

20

22 38 56 72 104

0 0.0%

2016 Q1 2017 Q1 2018 Q1 2019 Q1 2020 Q1

Technical profit (million USD) Technical profit/loss rate (%)

998.4 million USD was paid for insured losses dur- policyholders, while land vehicles liability paid 315 million USD,

ing the first quarter of 2020 aviation liability paid 15.4 thousand USD, liability for ships paid

316.2 thousand USD, general liability paid 10.9 million USD,

credit branch paid 922.4 thousand USD, bond insurance paid 85.2

During the first quarter of 2020, Turkish insurance market paid thousand USD, financial losses paid 1.5 million USD, and legal

a net of 822 million 777 thousand USD for insured losses in the protection paid 115.1 thousand USD.

non-life segment and 175 million 632 thousand USD in the life seg-

ment. Total net amount of losses paid to policyholders reached 998

million 409 thousand USD in the first quarter, compared to 887 Traffic branch reported profit after a long time

million TL in the same quarter of last year; and this has been an

increase of 12.5 percent. Written premiums made a big influence After a very long time, traffic insurance which is the driving force

on technical premiums during the first quarter of 2020, reaching 1 of Turkish insurance market, reported technical profit in the first

billion 717 million USD in the non-life segment, and 587 million quarter of 2020. Traffic insurance made a profit of 9 million USD,

241 thousand USD in the life segment. compared to a loss of 55 million 207 thousand USD in the first

quarter of 2019. Written premiums in the traffic insurance exceed-

ed 467 million USD, and paid losses was reported as 292 million

The amount of losses paid was reported as 5.8 million USD in the

accident branch, 216.7 million USD in sickness/health branch, USD in the first quarter of 2020. Technical profitability of mo-

189.7 million USD in land vehicles branch, 850.6 thousand USD tor own damage reached 100 million USD, with written premiums

in aviation, 4.4 million USD in ships hull and machinery, 3.8 mil- standing at 336 million USD and paid losses at 175 million USD.

lion USD in marine, and 43 million USD in fire and natural forc- In the first quarter of 2019, technical profit of this branch was

es. General losses branch paid 29.1 million USD for the losses of reported as 47 million USD.

Technical profit and loss in selected branches by first quarters (USD)

Accident Land Vehicles General Losses Land Vehicles Marine Fire And Natural Sickness/Health Legal Protection Financial Losses Aviation Liability Bond Insurance Credit General Liability

Liability Forces

2016 Q1 15,698,882 19,954,731 6,892,216 -45,867,695 7,577,188 13,111,455 2,357,911 2,243,358 779,332 -142,923 -17,050 -3,932,468 -4,904,194

2017 Q1 23,556,634 19,153,943 9,355,123 21,352,312 6,379,254 14,102,515 8,803,891 4,271,528 681,740 -50,026 -521,486 -245,029 -15,460,862

2018 Q1 32,400,028 23,785,992 14,380,363 -687,115 9,022,856 31,185,923 10,762,919 6,882,416 2,546,236 145,401 1,266,761 190,884 4,704,216

2019 Q1 42,165,329 46,725,266 26,439,429 -54,320,247 11,930,470 21,115,760 23,821,187 6,798,454 2,969,290 389,445 46,568 -2,015,454 5,322,721

2020 Q1 50,383,590 99,710,524 21,583,044 18,118,132 13,028,107 40,201,780 37,322,760 5,467,682 2,034,800 72,945 1,208,672 822,393 -5,828,841