Page 26 - Turkinsurance Digital Magazine

P. 26

26 pension outlook

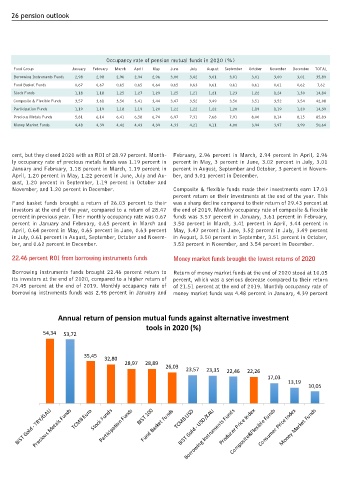

Occupancy rate of pension mutual funds in 2020 (%)

Fund Group January February March April May June July August September October November December TOTAL

Borrowing Instruments Funds 2,98 2,98 2,96 2,94 2,96 3,00 3,02 3,01 3,01 3,01 3,00 3,01 35,89

Fund Basket Funds 0,67 0,67 0,65 0,65 0,64 0,65 0,63 0,61 0,61 0,61 0,61 0,62 7,62

Stock Funds 1,18 1,18 1,25 1,27 1,29 1,25 1,21 1,21 1,23 1,22 1,24 1,30 14,84

Composite & Flexible Funds 3,57 3,61 3,50 3,41 3,44 3,47 3,52 3,49 3,50 3,51 3,52 3,54 42,08

Participation Funds 1,19 1,19 1,18 1,19 1,20 1,22 1,22 1,22 1,20 1,19 1,19 1,20 14,39

Precious Metals Funds 5,81 6,14 6,41 6,58 6,74 6,97 7,31 7,68 7,91 8,00 8,14 8,15 85,83

Money Market Funds 4,48 4,39 4,42 4,43 4,39 4,33 4,21 4,11 4,00 3,94 3,97 3,99 50,64

cent, but they closed 2020 with an ROI of 28.97 percent. Month- February, 2.96 percent in March, 2.94 percent in April, 2.96

ly occupancy rate of precious metals funds was 1.19 percent in percent in May, 3 percent in June, 3.02 percent in July, 3.01

January and February, 1.18 percent in March, 1.19 percent in percent in August, September and October, 3 percent in Novem-

April, 1.20 percent in May, 1.22 percent in June, July and Au- ber, and 3.01 percent in December.

gust, 1.20 percent in September, 1.19 percent in October and

November, and 1.20 percent in December. Composite & flexible funds made their investments earn 17.03

percent return on their investments at the end of the year. This

Fund basket funds brought a return of 26.03 percent to their was a sharp decline compared to their return of 29.43 percent at

investors at the end of the year, compared to a return of 28.47 the end of 2019. Monthly occupancy rate of composite & flexible

percent in previous year. Their monthly occupancy rate was 0.67 funds was 3.57 percent in January, 3.61 percent in February,

percent in January and February, 0.65 percent in March and 3.50 percent in March, 3.41 percent in April, 3.44 percent in

April, 0.64 percent in May, 0.65 percent in June, 0.63 percent May, 3.47 percent in June, 3.52 percent in July, 3.49 percent

in July, 0.61 percent in August, September, October and Novem- in August, 3.50 percent in September, 3.51 percent in October,

ber, and 0.62 percent in December. 3.52 percent in November, and 3.54 percent in December.

22.46 percent ROI from borrowing instruments funds Money market funds brought the lowest returns of 2020

Borrowing instruments funds brought 22.46 percent return to Return of money market funds at the end of 2020 stood at 10.05

its investors at the end of 2020, compared to a higher return of percent, which was a serious decrease compared to their return

24.45 percent at the end of 2019. Monthly occupancy rate of of 21.51 percent at the end of 2019. Monthly occupancy rate of

borrowing instruments funds was 2.98 percent in January and money market funds was 4.48 percent in January, 4.39 percent

Annual return of pension mutual funds against alternative investment

tools in 2020 (%)

54,34 53,72

35,45 32,80

28,97 28,89

26,03 23,57 23,35 22,46 22,26

17,03

13,19

10,05

Composite&Flexible Funds

Money Market Funds

Borrowing Instruments Funds

Precious Metals Funds

BIST Gold - TRY/GAU TCMB Euro Stock Funds BIST 100 TCMB USD Producer Price Index Consumer Price Index

Participation Funds

BIST Gold - USD/XAU

Fund Basket Funds