Page 35 - Turkinsurance Digital Magazine

P. 35

33

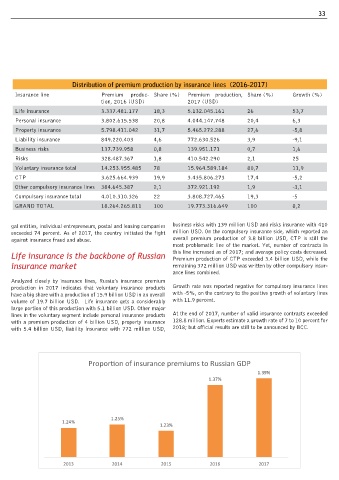

Distribution of premium production by insurance lines (2016-2017)

Insurance line Premium produc- Share (%) Premium production, Share (%) Growth (%)

tion, 2016 (USD) 2017 (USD)

Life insurance 3.337.481.177 18,3 5.132.045.161 26 53,7

Personal insurance 3.802.615.538 20,8 4.044.147.748 20,4 6,3

Property insurance 5.798.411.042 31,7 5.465.272.288 27,6 -5,8

Liability insurance 849.220.403 4,6 772.630.526 3,9 -9,1

Business risks 137.739.958 0,8 139.951.171 0,7 1,6

Risks 328.487.367 1,8 410.542.290 2,1 25

Voluntary insurance total 14.253.955.485 78 15.964.589.184 80,7 11,9

CTP 3.625.664.939 19,9 3.435.806.273 17,4 -5,2

Other compulsory insurance lines 384.645.387 2,1 372.921.192 1,9 -3,1

Compulsory insurance total 4.010.310.326 22 3.808.727.465 19,3 -5

GRAND TOTAL 18.264.265.811 100 19.773.316.649 100 8,2

gal entities, individual entrepreneurs, postal and leasing companies business risks with 139 million USD and risks insurance with 410

exceeded 74 percent. As of 2017, the country initiated the fight million USD. On the compulsory insurance side, which reported an

against insurance fraud and abuse. overall premium production of 3.8 billion USD, CTP is still the

most problematic line of the market. Yet, number of contracts in

Life insurance is the backbone of Russian this line increased as of 2017; and average policy costs decreased.

Premium production of CTP exceeded 3.4 billion USD, while the

insurance market remaining 372 million USD was written by other compulsory insur-

ance lines combined.

Analyzed closely by insurance lines, Russia’s insurance premium

production in 2017 indicates that voluntary insurance products Growth rate was reported negative for compulsory insurance lines

have a big share with a production of 15.9 billion USD in an overall with -5%, on the contrary to the positive growth of voluntary lines

volume of 19.7 billion USD. Life insurance gets a considerably with 11.9 percent.

large portion of this production with 5.1 billion USD. Other major

lines in the voluntary segment include personal insurance products At the end of 2017, number of valid insurance contracts exceeded

with a premium production of 4 billion USD, property insurance 128.8 million. Experts estimate a growth rate of 7 to 10 percent for

with 5.4 billion USD, liability insurance with 772 million USD, 2018; but official results are still to be announced by BCC.

Propor1on of insurance premiums to Russian GDP

1.39%

1.37%

1.25%

1.24%

1.23%

2013 2014 2015 2016 2017